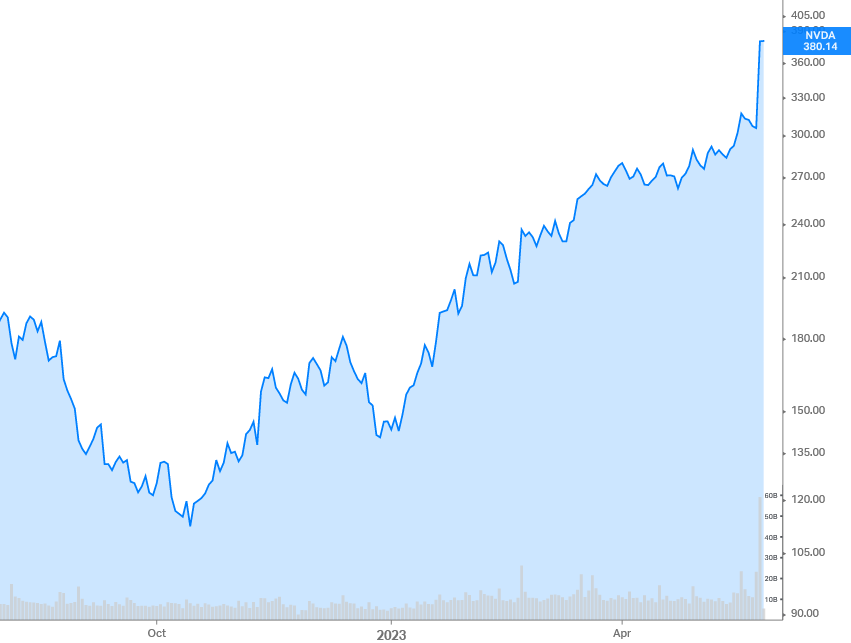

The stock of the U.S. semiconductor manufacturer, described in more detail in the last article, jumped more than 26% after the announcement of new financial results last Wednesday, to almost $395 at times, far exceeding the target of $330 mentioned in the last article.

The share has thus clearly exceeded the old all-time high of around 346 US dollars and marked a new all-time high.

The fact that it almost broke through the USD 400 mark was due to the very positive business results of the past quarter.

Instead of the previously expected earnings of $0.92 per share, earnings of $1.09 per share were reported, nearly 19% more than expected.

Sales were also well above expectations. The estimated value here was around $6.5 billion,

but the actual value was approximately 11% higher at around $7.2 billion.

The figures also increased significantly compared with the last quarter. For example, earnings per share in February were still $0.88

while sales were still at $6.1 billion.

The new figures here therefore correspond to a significant increase, namely of approximately 24% in profit and 18% in sales.

This also fulfills the previously made prediction that the high use of powerful chips, such as those produced by Nvidia, could lead to a significant increase in profits and sales due to the currently exploding use of artificial intelligence in numerous areas.

The current extremely high valuation of the share price with an exaggerated price/earnings ratio of over 144 includes the expectation,

that this development will continue as before.

However, if this market turns out to be different again, it could be a disappointment for a majority of investors,

which could then sell their shares promptly. Therefore, one cannot give a buy recommendation for such a highly valued share.