GIDA project.

Consultancy & Research GmbH

GIDA project: Automated information evaluation for trade decisions

As a technology-oriented and innovative financial services provider, JRC Capital relies on continuous scientific research

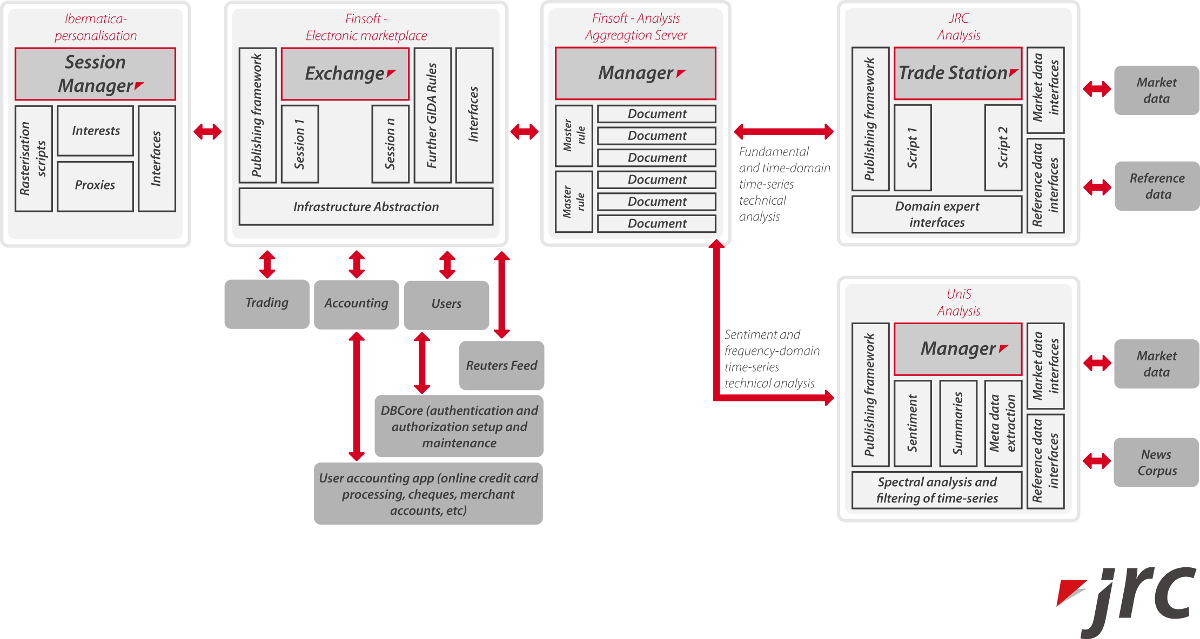

In 2001 the EU-funded project “ G eneric I. information-based D. ecision A. ssistant (GIDA) ”, which JRC Capital managed as initiator and project coordinator together with three partners for two years. GIDA’s focus was on the automated evaluation of information from news and other texts in order to be able to use them for trading decisions. We implemented the project together with Finsoft (UK), Ibermática, SA (ES) and the University of Surrey (UK) under the EU project number IST-2000-31123 (GIDA).

Goals of GIDA

Two main goals were formulated for the project. On the one hand, the focus was on developing a cross-application execution platform. In this context, text analysis techniques for information extraction, classification and automatic summary should be further developed and linked with forecasting models for financial analysis. The second goal was the integration of personalization methods so that users could be presented with individual content tailored to their profile.

The aim of the GIDA project based on this was the development of new types of information services and advisory services for financial investors on the platform to be implemented.

Enormous vision for the benefit of financial investors

The GIDA project was a very complex project and still affects the trading systems of JRC Capital today. It was one of the first projects in which current software technologies were still used for research at the beginning of the millennium. In the field of software engineering, this concerns the early use of web services and XML as well as research into possible uses of personalized services in the sense of a recommender system.

Some key requirements had to be met for use in the financial sector. Filtering and aggregating information as well as a freely configurable user interface were essential. The focus was on first attempts at a sentiment analysis as part of the platform. For this purpose, trading signals were also given confidence values in combination with frequency considerations of keyword-based news analysis. In summary, the task was: Development of a personalized financial information system for both institutional investors and experienced private traders.

Project results are still effective today

GIDA combines the analysis of technical data series with fundamental information extracted from text messages on one platform. It therefore offers a decision support function based on information and data. Within a unique system or software environment, there is an automatic and personalized filter for information, for text recognition for news and events. This provides the basis for the mathematical processing of the information with applicable evaluations and automatic interpretations as the subject of further research. In connection with this, but independent of GIDA, the methodological refinement of information extraction and information processing from full texts could be designed successfully. It also formed the basis for further research.

Use of GIDA for our trading systems

The experience gained with the GIDA project is still paying off today for our trading systems and our core strategy. Especially when looking at structural breaks and turning points, there was a further development. JRC was also able to benefit from the GIDA project with the automated publication of system signals, as well as from tests and extensive user feedback on the project’s internet portal test environment.

JRC Capital Management

Asset management in Berlin:

Get free advice now!

We would be happy to inform you personally about the costs and possibilities of your managed account at JRC Capital as part of your wealth management strategy. Are you interested in our corporate account? Or do you have any further questions about our services? Contact us by phone or email. We are looking forward to your contact.