![]()

Currency Hedging & Risk Management Service

Dynamic protection of foreign currency investments against

Exchange rate fluctuations

Global investment, trade and entrepreneurship expose actors to the risks of exchange rate fluctuations. CHRES uses proven foreign exchange trading strategies to identify and mitigate these risks.

When investing or doing business in foreign countries, the risk of fluctuating exchange rates is often overlooked. While the actual value of the asset denominated in the foreign currency may not change, the actual cash value received by the investor after conversion into euro may fluctuate significantly due to the exchange rate.

CHRES uses forex trading strategies with a 20-year track record and state-of-the-art technology to identify trends and dynamically increase or decrease protection. Users can decide on their level of security by selecting one of several scenarios per currency.

CHRES Project – Currency Hedging and Risk Management Service – YouTube

Discover more on eitdigital.eu/innovation-factory/

Most important advantages

- The CHRES platform uses reliable knowledge of the foreign exchange markets and extensive IT expertise to reduce hedging costs and increase efficiency:

- Reduce the currency risks of investors invested in foreign assets through proven currency trading strategies.

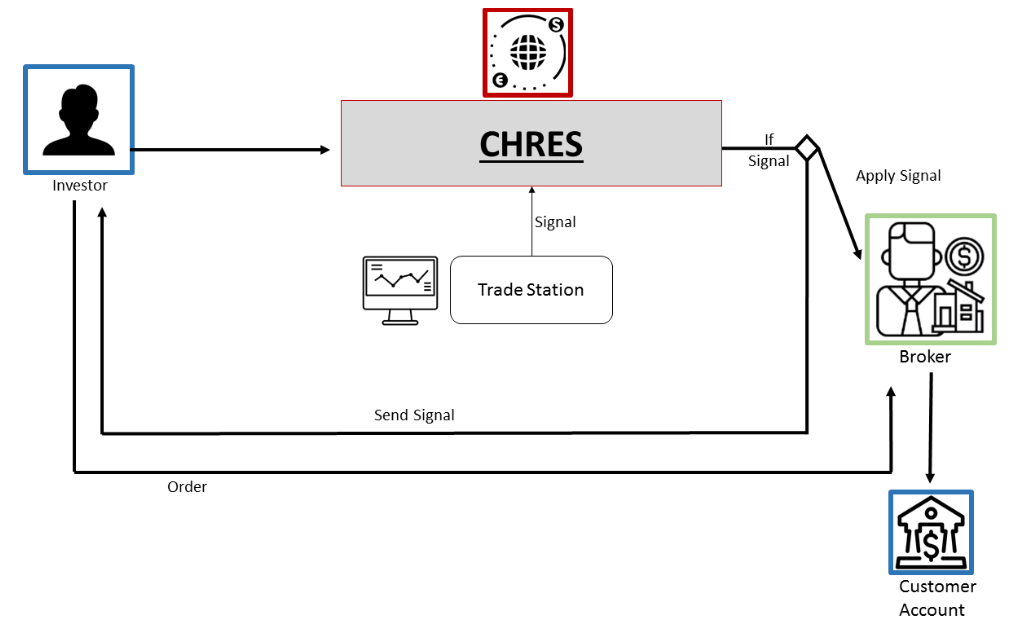

- The decision to hedge is made by the investor and if desired, this process, the order execution, can be automated.

- Access to the expertise and technology of leading currency experts

Competitive pricing and high liquidity with direct access to the interbank market for foreign exchange transactions.

Trading models for all major currency pairs, based on extensive mathematical and statistical models, are the foundation of the CHRES platform. Short-, medium- and long-term currency trading systems are used to determine the hedge ratio and generate signals for the investor.

Algorithms interfaced with our execution platforms allow us to automatically execute the signals generated by the CHRES platform on our client’s custody account.

CHRES is an innovation activity proudly supported by EIT Digital.

CHRES is an innovation activity proudly supported by EIT Digital.