By: Henry Philippson

Review:

The conclusion of the latest review (“DAX commentary: Poor sentiment as a buying opportunity?”) from last Friday was as follows: “The relative weakness of the German benchmark index in recent trading days is almost eerie. Either a major quick crash or a recovery move of several hundred points is in the offing here. Due to the multiple bullish divergences in the RSI, I currently prefer the bullish variant….The mood is currently very bad, best conditions for a strong bear market rally!”

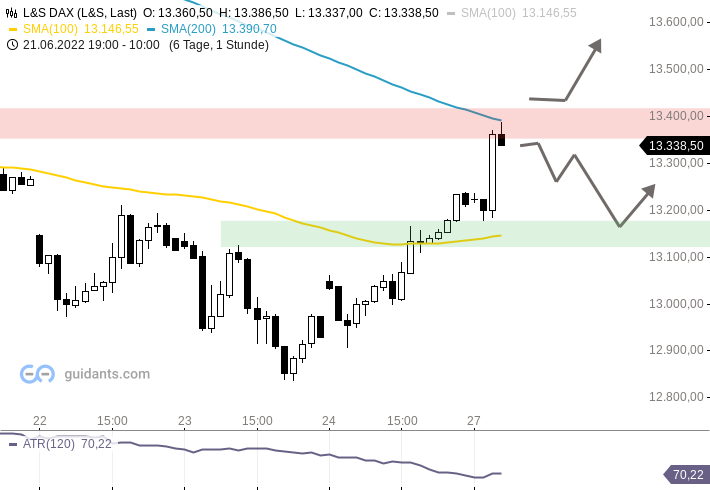

After Friday’s opening, which was again weak, the index was able to stabilize and went out after a 200-point recovery at the high of the day. At the start of the new week, the favored upward movement continues – the index brings the predicted bear market rally of “several hundred points”.

Outlook:

With the SMA200 in the hourly chart just below the 13,400 level, a first potential recovery target on the upside has been worked off. After the index was able to recover from Friday’s low over 450 points, however, at least partial profit-taking is advisable here. However, as long as the index moves above 13,100 points, (larger!!) setbacks tend to remain worth buying. Only below 13,100 points the bears get tailwind again, until then the bulls remain at the helm.