Review

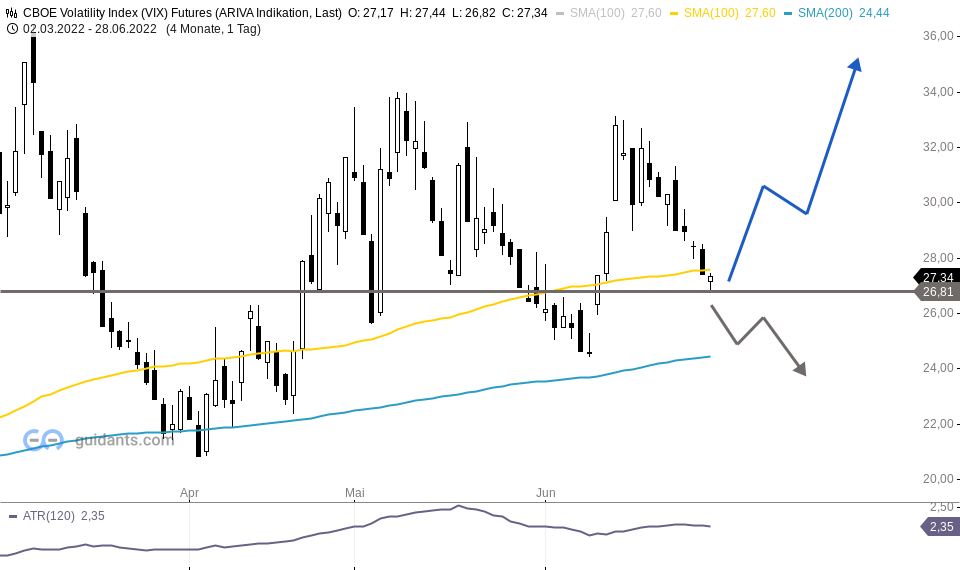

The Volatility Index on the S&P 500 has seen a decline of about 8 points since June 16, from 34.90 to 26.70. The reason for this was the recovery of the largest American index in the course of last week,

especially last Thursday and Friday.

One of the reasons for this was that unemployment figures remained relatively constant over the past two weeks.

Current

At 26.80, I now see a strong support level for the VIX, whose breakthrough remains unlikely in the current volatile market environment. If it does, the price could fall further towards 23.70 at levels below 25.50.

However, I think a renewed rise from the current price to 35.50 is more likely, depending on the upcoming figures in the next few days and subsequent economic events, especially concerning the US market.

Especially when looking at the correlating S&P, I think a rise of 50-100 points to a maximum of 4000 points is possible there, as there is a strong downtrendline above it.

However, a correction to below 3800 is more likely there in my opinion, which could cause the aforementioned VIX rise.

Jonas Wuttig