As an investor, it is difficult at the moment to earn attractive interest rates with traditional financial instruments such as a savings account, as these are currently still quite low. Especially due to the current high inflation, these investment methods can no longer keep up. However, in order to continue to invest one’s money profitably, alternatives are needed.

The Berlin-based JRC Capital would like to offer its customers the opportunity to invest their own money in such a way that attractive profits can still be earned. The company’s many years of experience can, with a little risk-taking on the part of investors, help to increase their own capital.

Asset management plays a key role in this. By investing selectively in foreign exchange and financial markets, asset management aims to exploit fluctuations profitably. JRC Capital has specialized in this area and supports investors with experience and know-how.

In addition, JRC provides free analysis almost daily, which investors can use for their own investments regardless of experience level. The reader is given the opportunity to find out about current topics and developments in the financial markets.

The advantage for the reader is the time saved by not having to go to various sources for information. The analysis service is to be further expanded in the future and will then also be available via the Berlin experts’ newsletter. This makes the service even easier and faster to access.

In addition to asset management, JRC Capital is also involved in various international publicly funded research projects. The aim here is the continuous further development of the company’s internal know-how. These projects currently include the Triple A project and the Infinitech project.

Triple A

The overall goal of the Triple A project is to help financial institutions and project developers increase the energy efficiency of their investments and make them more transparent, predictable and attractive. The project approach thus pursues the selection of suitable investment cases that promote sustainable growth while demonstrating a high capacity to meet their obligations.

The project is being carried out by a consortium of university, research and industrial partners from Bulgaria, the Czech Republic, Germany, Greece, Italy, Lithuania, Spain and the Netherlands.

The focus is on answering the following questions:

How can the financing instruments and risks be assessed at an early stage?

How can Triple A investments be implemented based on selected key indicators?

How can the identified investment ideas be assigned to possible financing models?

Infinitech

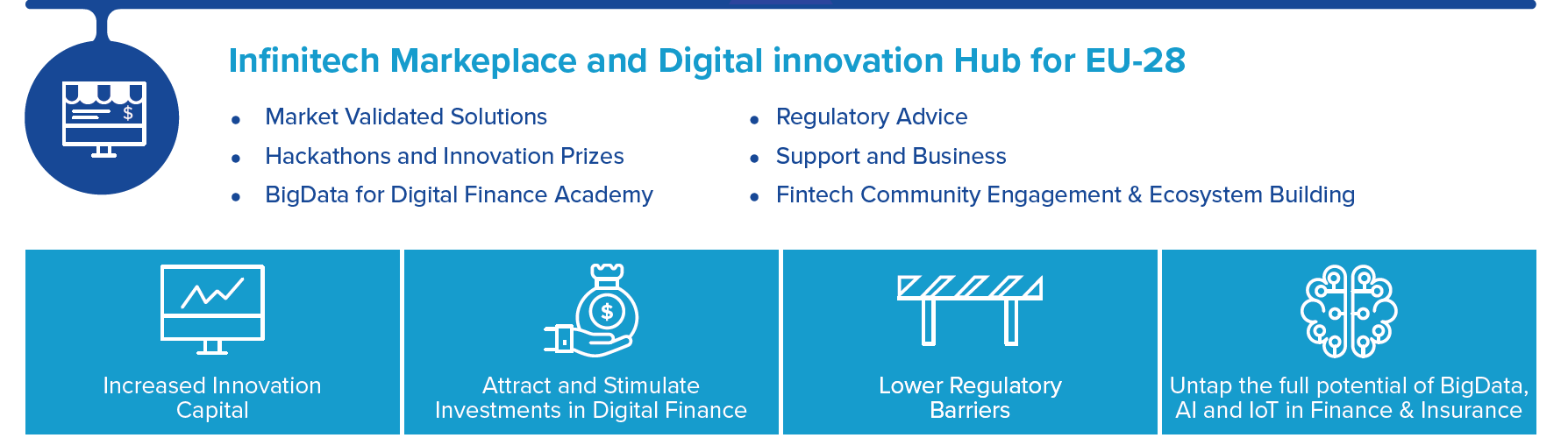

INFINITECH is a joint project of leading global ICT and financial companies to lower the barriers to BigData/KI-driven innovation, improve regulatory compliance, and encourage additional investment.

Infinitech’s focus is on developing a platform for novel BigData technologies for seamless management and querying of all types of data, interoperable data analytics, blockchain-based data sharing, real-time analytics, and libraries of advanced AI algorithms. Add to that regulatory tools that incorporate various data governance features to facilitate compliance. Also included are nine novel and configurable testbeds and sandboxes, each providing open interfaces and other resources for validating autonomous and personalized solutions, including a unique collection of datasets for the financial and insurance sectors.

The results of the project will be validated in the context of 14 influential pilot applications that provide full coverage of sectors, including:

Know Your Customer (KYC), customer analytics, personalized portfolio management, credit risk assessment, predictive financial crime analytics, fraud prevention, usage-based insurance, agro-insurance, and more.

If you would like to learn more about asset management opportunities or are interested in research projects, please feel free to contact JRC Capital through their website at www.jrconline.com.