Summary

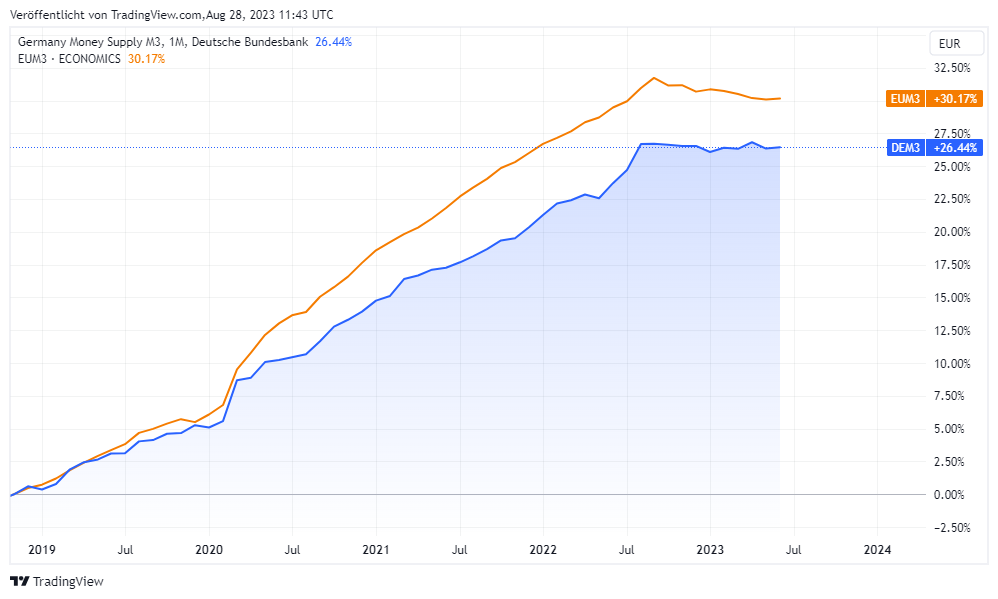

- M3 money supply:

- M3 money supply growth declined to -0.4% from 0.6% in June.

- M1, consisting of currency and overnight deposits, fell to -9.2% from -8.0% in June.

- Short-term deposits (M2-M1) decreased slightly from 24.0% to 23.9%.

- Marketable instruments (M3-M2) decreased from 22.8% to 20.6%.

- Contributions to M3 growth:

- M1 contributed -6.7 percentage points.

- Short-term deposits (M2-M1) added 5.3 percentage points.

- Marketable instruments (M3-M2) contributed 0.9 percentage points.

- Deposit growth by sector:

- Deposits from households grew by 0.7% (previously 1.1%).

- Deposits from nonfinancial corporations contracted to -0.6% (previously 0.8%).

- Deposits from non-monetary financial companies decreased to -15.4% (previously -14.2%).

- M3 counterparts:

- Net external assets contributed 1.5 percentage points.

- Loans to the private sector contributed 1.2 percentage points.

- Loans to the general government decreased by -1.1 percentage points.

- Non-current financial liabilities decreased by -1.6 percentage points.

- The remaining M3 counterparts decreased by -0.4 percentage points.

- Credit Dynamics:

- Total loans to euro area residents grew by 0.1%.

- Loans to the general government decreased to -2.9%.

- Loans to the private sector decreased to 1.3%.

- Adjusted loans to the private sector fell to 1.6%.

- Adjusted loans to households decreased to 1.3%.

- Adjusted loans to non-financial corporations decreased to 2.2%.

Note: Data are adjusted for seasonal and calendar effects. “Private sector” refers to non-MFI, exclusive of general government.

https://www.ecb.europa.eu/press/pr/stats/md/html/ecb.md2307~13b4bee1e4.en.html

tradingview.com