Review

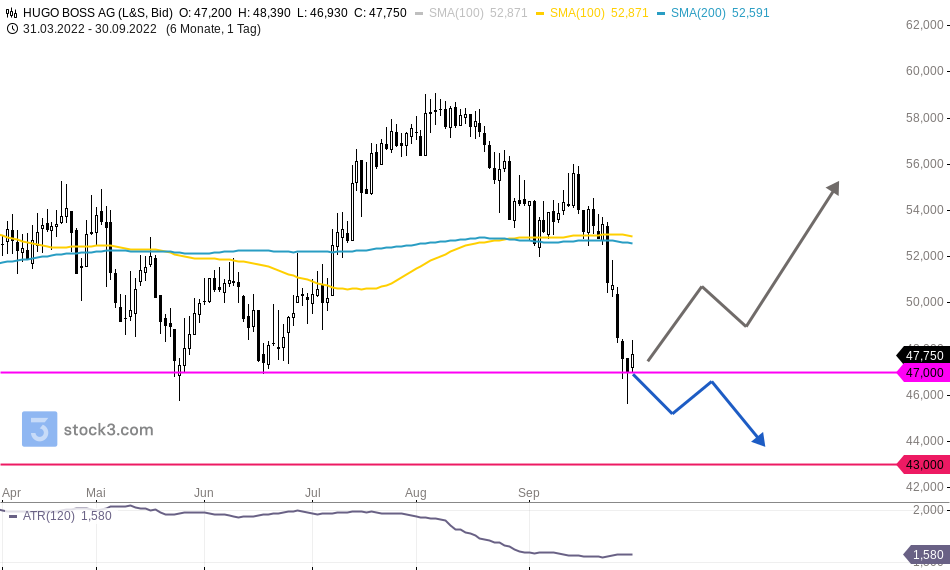

The price of the fashion company Hugo Boss has been in a sideways movement for more than a year, with the price moving between €40.00 and €60.00. After a few attempts to overcome the €59.00 resistance level in early August 2022, the share price has fallen back by more than 22%, recently breaking through a support at €47.00.

But just now the private bank Berenberg has raised its price target to 57.80 euros, thus giving a buy signal. According to analysts, the new strategy of the fashion group and the complete renewal of the brand provide a new customer profile, accelerating the momentum in previously less penetrated markets. Despite the short-term recession risks, the strong short-term momentum and the clearly positive medium-term outlook prompt analysts to take a positive view of the stock.

Current

The publication of the bank’s new price target led to a short-term recovery in the share price and a brief rise of over 4% at times. However, this recovery movement weakened again today to the weekend and could be broken off again from Monday. Above all, the break of the €47.00 support can signal a continuation of the medium-term downward movement. Thus, a price decline to the next support at €43.00 remains very likely. Otherwise, the share price could continue its recovery towards the €55.00 mark.