The well-known American investor Warren Buffet, who has repeatedly generated headlines with well-timed investment decisions,

divested some of its bank stock investments some time ago. In addition, it recently became known,

that the investor has divested himself of shares worth more than $13 billion through his company Berkshire Hathaway.

Instead, he invested significantly more money in short-term U.S. government bonds, from which he hopes to make a profit of more than $5 billion this year.

When interest rates rise in the market, it means that there are higher interest coupons for new bonds than for current issues.

The higher yields cause the prices of bonds already issued to fall.

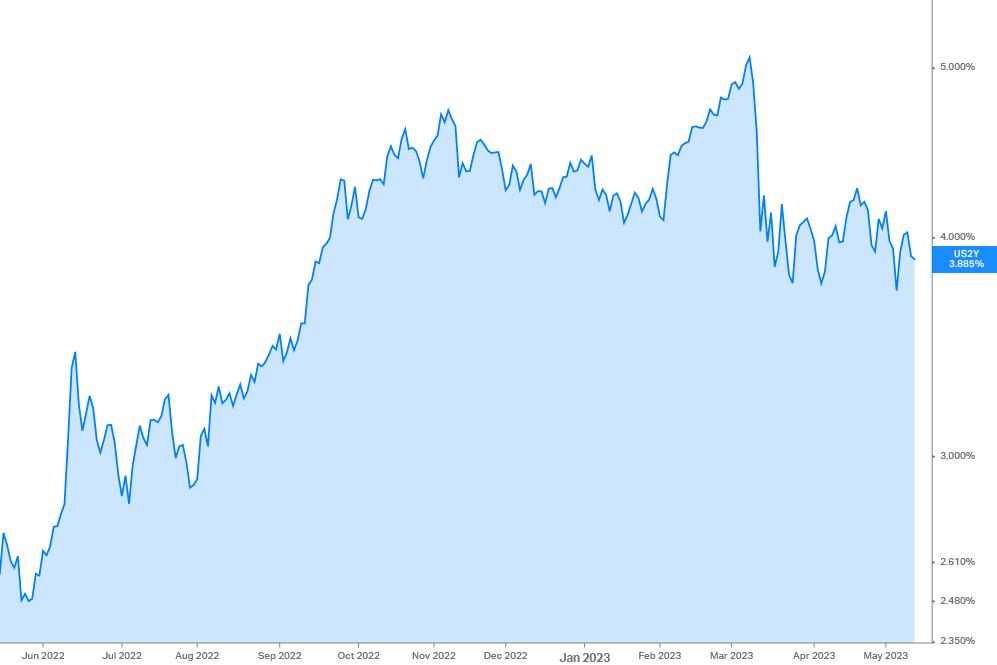

Since 03/16/2020, the FED has raised the federal funds rate from 0.25% to 5.25%. Especially with the interest rate hike on 07/28/2022,

when the key interest rate was raised to 2.5% for the first time in more than 14 years, U.S. Treasuries with 2 and 5-year maturities reacted with price lows.

Yields on 2-year Treasuries fell to 2.88%, while those on 5-year Treasuries fell to 2.71%.

Since then, bond yields have risen, partly due to further interest rate hikes,

and currently stand at 3.95% for 2-year Treasuries and 3.41% for 5-year Treasuries.

Since the FED has not yet signaled an end to its rate hikes, it could be that even higher yields will be reached here.

Since bonds often outperform during periods of lower equity returns, they could be an investment alternative during these periods.

This is shown by a simple comparison of the returns of the S&P500 versus the 2-year Treasury.

Thus, an investment in the S&P500 at the beginning of the year would be worth 14% less today, at times it was even a 27% loss.

The yield on 2-year Treasurys rose from 0.73% to 3.94% over the same period, and was as high as 4.86% at times.