Following the crash on the banking market in March, the situation has now calmed down somewhat.

However, many of the shares affected were unable to build on their previous rises.

The UBS Group share, for example, is once again in a strong downtrend and fell by over 8% a few days in a row.

The shares of banks such as Spain’s Banco Santander and Germany’s Commerzbank fared little better.

Shares in Unicredit and Wells Fargo also took a breather after rallies in the double-digit percentage range.

Of the banks just mentioned, however, only the Unicredit share was able to reach a new high as a result of the upward movement,

which also represents a 7-year high for the price trend.

Thus, after the bankruptcies of three U.S. regional banks and the takeover of the major Swiss bank Credit Suisse by UBS, the market seems to have quickly priced in the events and catapulted prices to levels similar to those reached a few months ago.

However, the market has also become aware of the current exceptional situation, with geopolitical tensions,

the U.S. national debt, inflation and the rapid turnaround in interest rates must be mentioned.

For example, the U.S. debt mountain recently grew to more than $37.4 trillion, a record high.

Especially in the banking sector, central bank lending is exploding.

Whereas before the banking crisis, loans were granted at a rate of around USD 10 billion per week, after the crisis the figure has risen to over USD 160 billion per week in some cases,

which the FED lends to the banks.

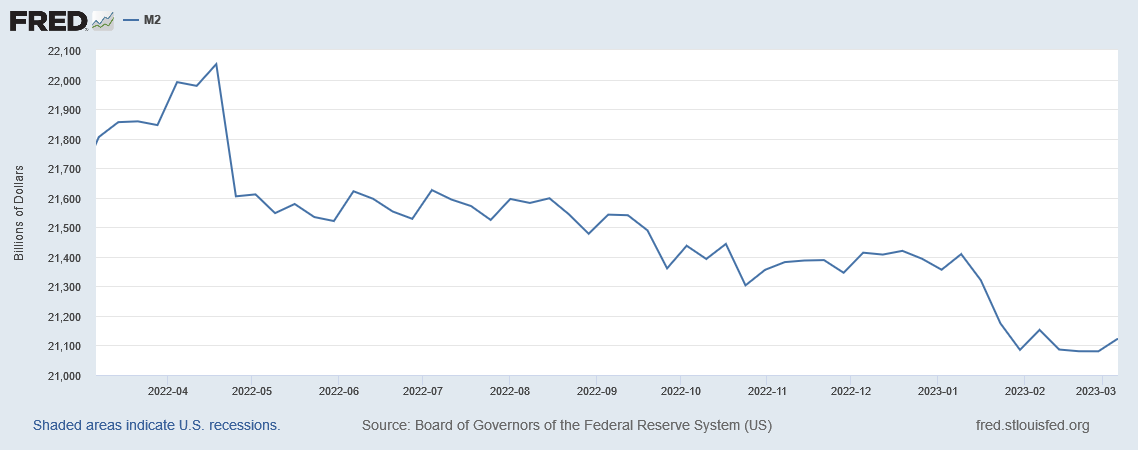

By contrast, the money supply in the U.S. has fallen at the fastest rate since the 1930s, which is a warning signal for the economy and the financial markets.

In February, for example, the M2 money supply fell by a not seasonally adjusted 2.2% year-on-year to $21.099 trillion.

The M2 money supply is a measure of how much cash and cash-like assets are in circulation in the U.S. economy.

Accordingly, the FED would have to stop raising interest rates soon, as growth, asset prices and, above all, high inflation should weaken.

Overall, then, the state of the economy, especially in the USA, is not particularly good.

It remains to be seen how the stock markets and especially bank stocks will develop in the near future.

In view of the high level of government debt and the reduced money supply with a possible decline in growth, an investment in bank shares is,

especially by U.S. banks, are currently quite risky.