After the Federal Reserve raised the key interest rate by 25 basis points to 5.25% on Wednesday, as expected, the ECB’s interest rate decision also followed yesterday (Thursday). The latter also raised the key interest rate by 25 basis points to 3.75%. The ECB is thus continuing its historically strong interest rate hikes, which are unprecedented since the introduction of the euro. One reason for this is that inflation in the euro zone still remained at 7% in April. In the USA, by contrast, inflation is now only 5%. However, the target of both central banks is 2% inflation. In the opinion of many analysts, further interest rate hikes are unlikely, as this could unsettle the markets too much.

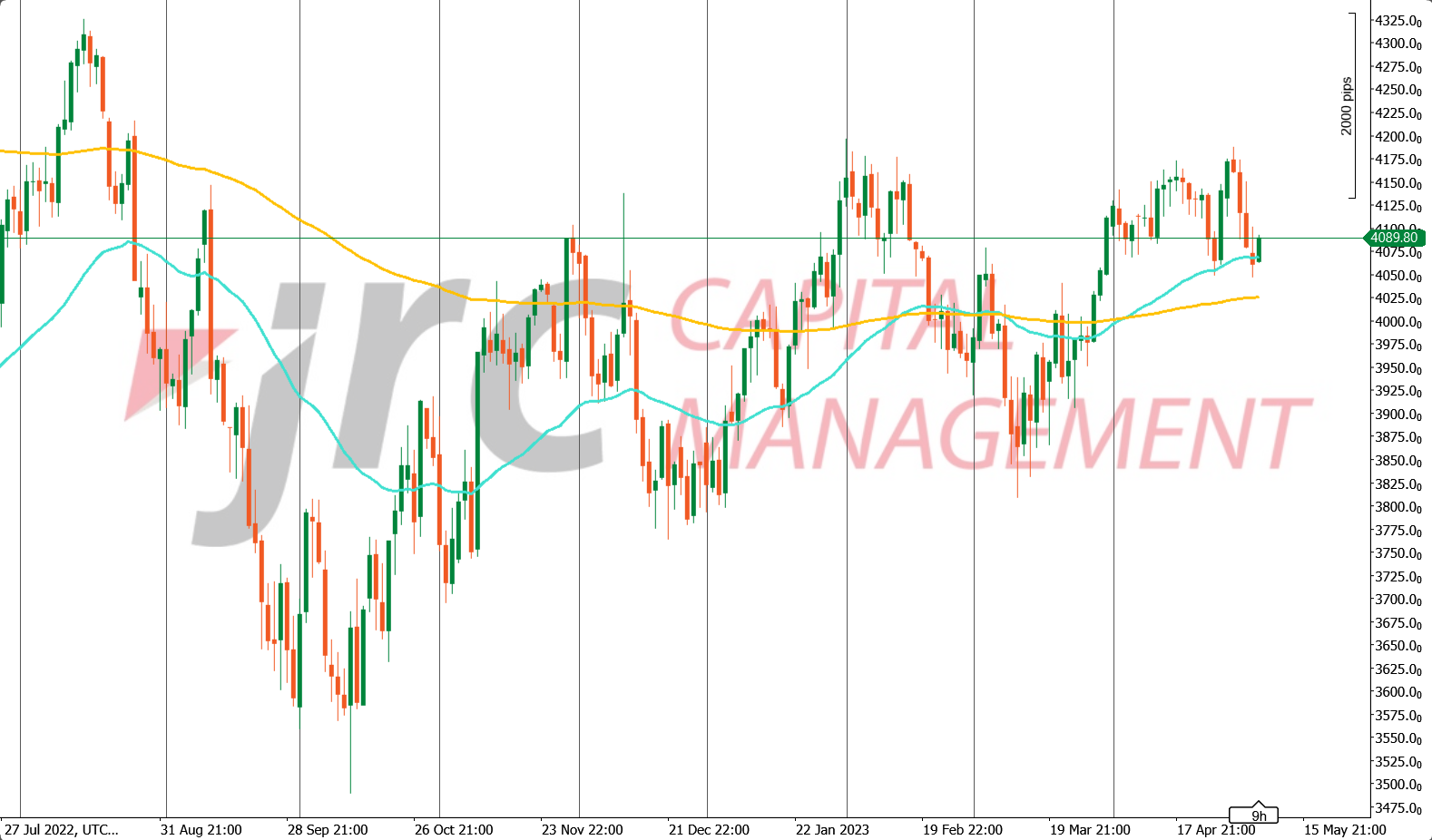

The markets reacted overwhelmingly negatively to the interest rate hikes. Thus, the S&P500 began a significant downward movement already on Tuesday. In addition, Initial Jobless Claims (weekly initial claims for unemployment benefits in the U.S.) were released yesterday and came in at 242,000, slightly above the expectation of 240,000. Thus, the index, which was still at 4168 points before the stock market opened on Tuesday, fell by 2.4% to 4061 points by yesterday’s close. The German benchmark index DAX fell yesterday, Thursday, only to about 15666 points, but today opened significantly higher at 15839 points. Currently, it is slightly lower again at 15777 points.

The dollar has weakened somewhat against the Japanese yen and the Canadian dollar in recent days. The British pound, the New Zealand dollar and the Australian dollar also recorded increases against the dollar. The euro, on the other hand, gained strength against the dollar and the Swiss franc, but fell against the Japanese yen and the British pound.

At the moment, it remains to be seen how the markets will behave until the weekend. Since the DAX in particular is currently in a sideways movement and the S&P500 has also only stayed between 3800 and 4200 points since November 2022, there is currently not much that can be interpreted into the market situation. However, new inflation figures from Germany and the U.S. are expected next Wednesday, which could bring new movement into the market.