Review

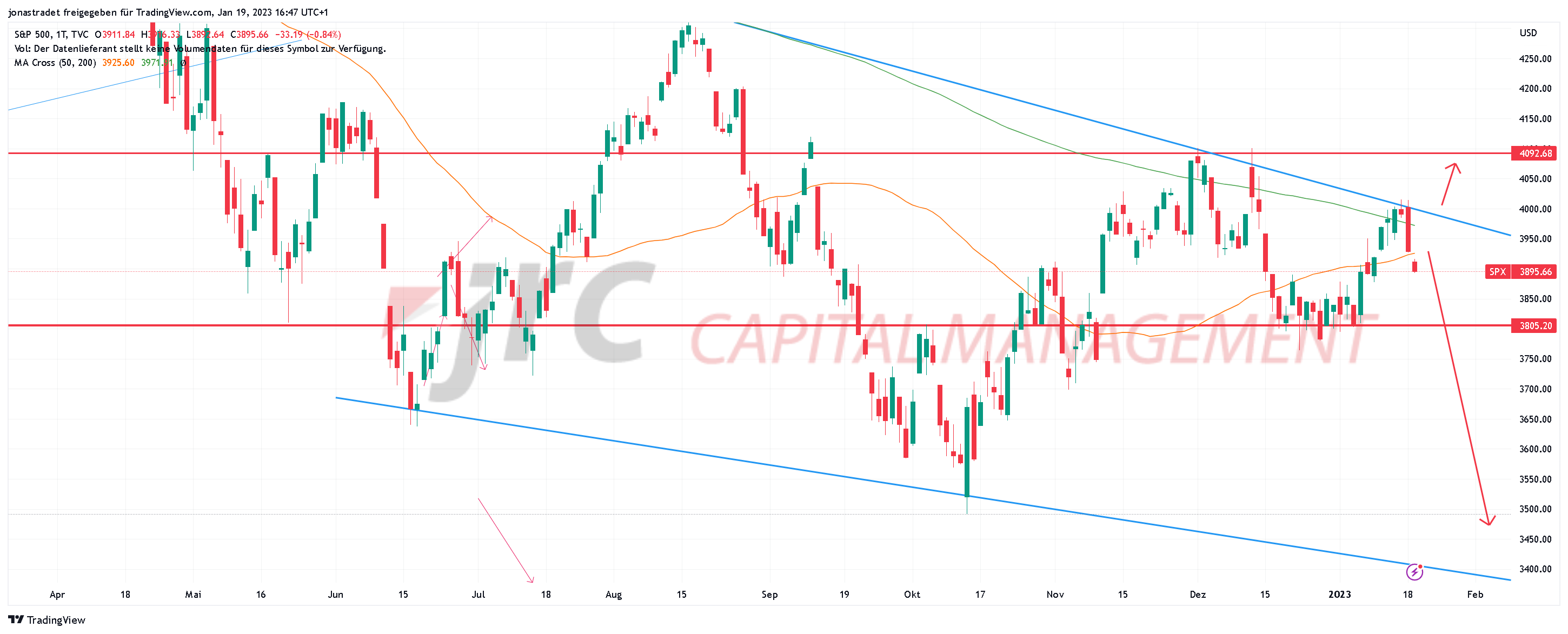

At yesterday’s close at around 3928 points, the S&P500 index closed with a significant loss compared to the previous day. Today, the index after the opening of the stock market so far moved further down with -0.6%. The price thus continues to confirm the downward trend that has remained intact for exactly one year and appears to be entering a new medium-term downward movement.

Outlook

Due to the events at the World Economic Forum in Davos, today’s FED appointments and tomorrow’s upcoming publication of the number of new applications for unemployment benefits in the U.S., stronger and unexpected movements, i.e. increasing volatility in the market is to be expected. Add to this the fact that the U.S. will reach its statutory debt limit of $31.4 trillion today, leading to a series of extraordinary measures to avoid a sovereign debt default. What measures will be applied remains to be seen, but this could also lead to increased volatility and an erosion of consumer confidence.

Analysis

In the area around 3805 points, a horizontal support was established at the turn of the year, which could become relevant in case of a possible continuation of the downward movement. A resistance in the upper area can be found at approx. 4093 points.

If the support holds and stops further downward movements, one could again assume a following upward movement. However, if it is breached, we could see a further downward movement towards 3700 points.

Otherwise, the price would have to cross the downtrend line at some point in the further course and thus break the long-term trend, which, however, remains rather unlikely for the time being due to the current bear market.