Review

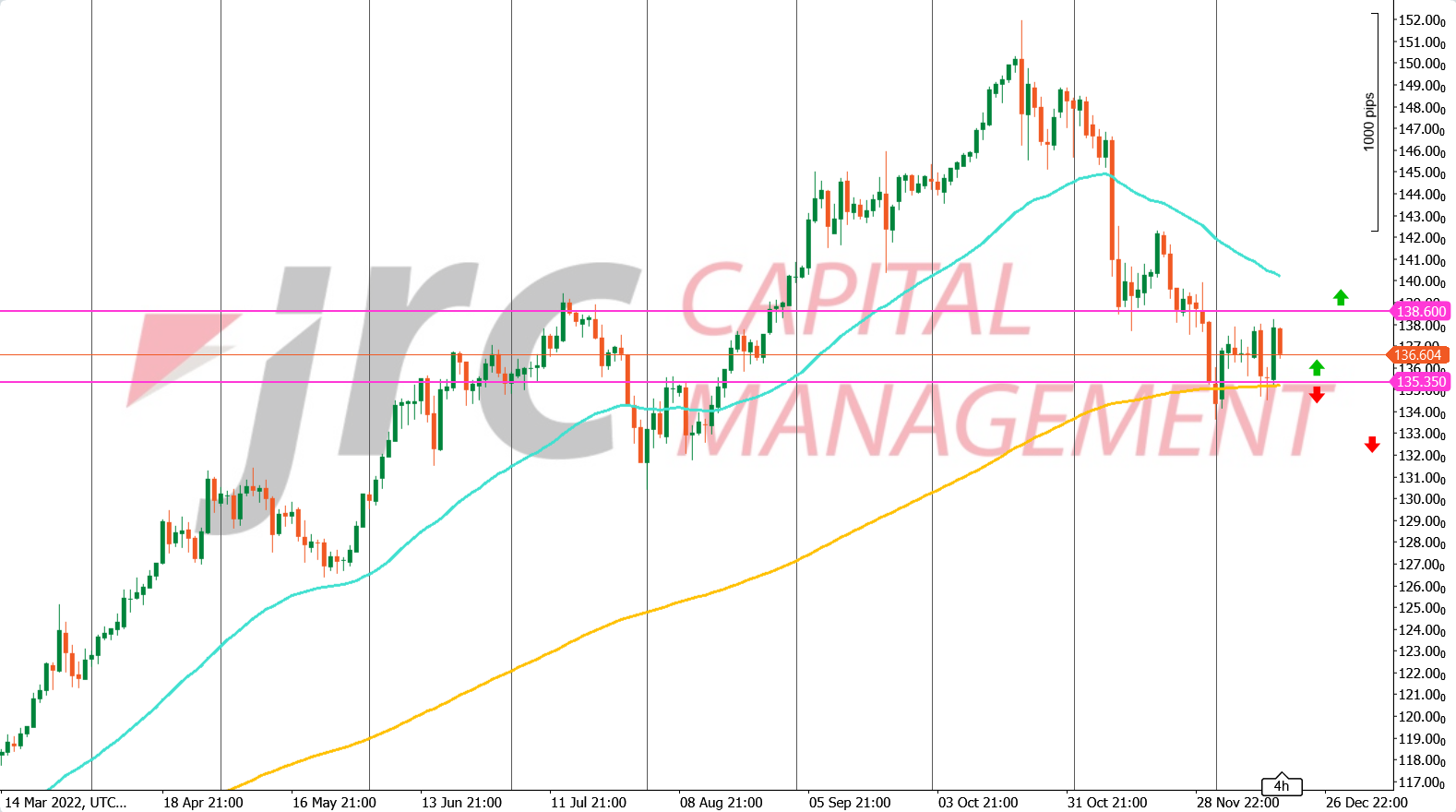

After Thursday’s close at around 137.80 yen, the currency pair has closed with a gain of almost 1.8%. Today, the U.S. dollar showed weaker again and the price moved down -0.8% so far. In the ongoing downtrend, the price had last marked a low at around 133.60 yen. After the price reached a high of about 138.20 yen yesterday, it then fell again by about 1.1%. The current sideways movement after the downtrend break on 26.10. and the subsequent price drop seems to form a bearflag.

Outlook

The chart situation in the daily chart has changed little in the current week. A short-term relevant horizontal support has been established in the area around 135.35 yen. The next important resistance is in the area of 138.60 yen. If the price continues to stay above the horizontal support and respects it, this can be interpreted as a bullish signal. Sollte diese jedoch durchbrochen werden, könnten wir eine Abwärtsbewegung bis unter das letzte Tief Richtung 132 Yen beobachten. Otherwise, the price could rise above the aforementioned resistance. If this is broken, we could see a further rise 141.50 yen, otherwise the price could continue to stay in the 136-137 yen range.