Review

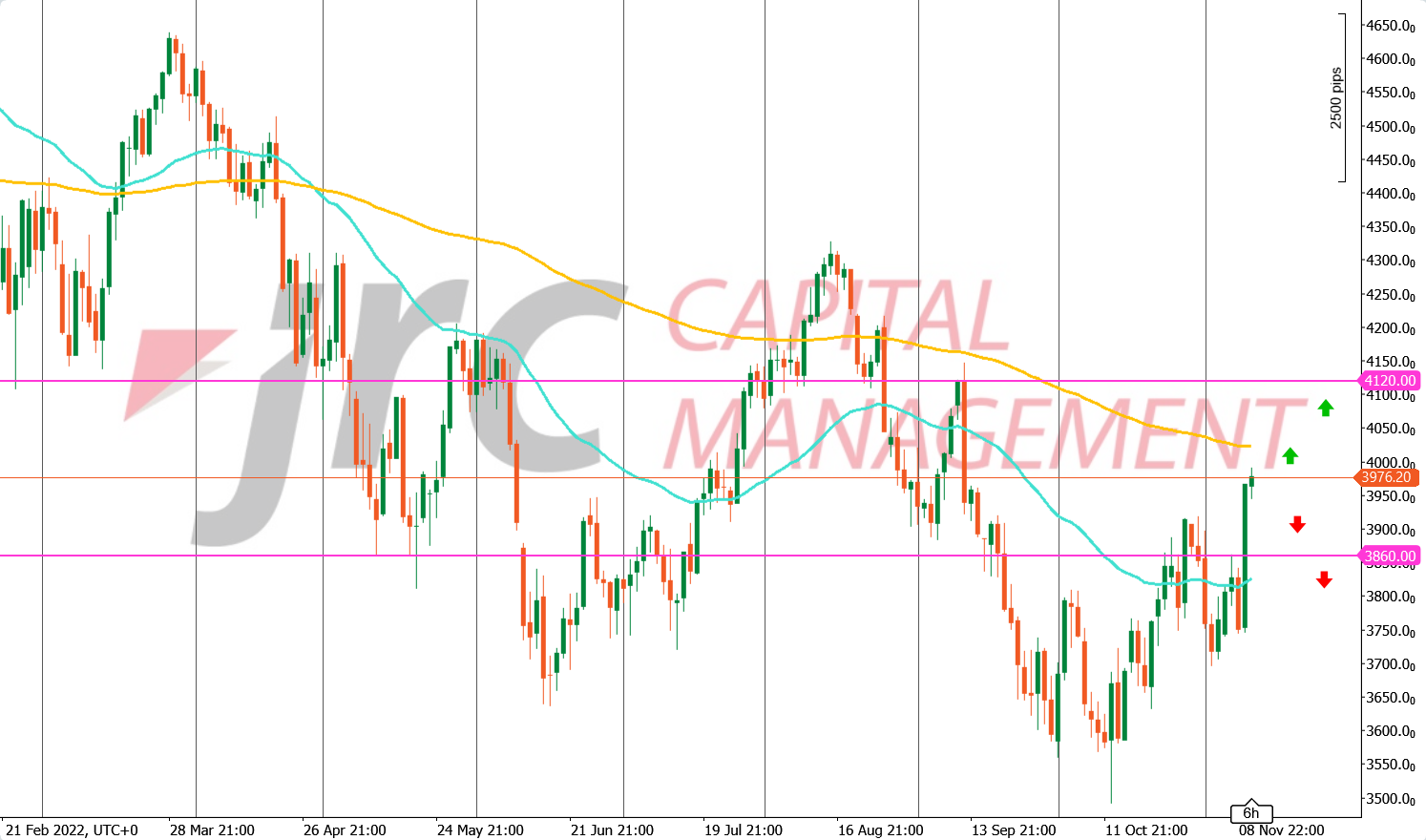

At yesterday’s close, the S&P500 index closed with strong gains at 3955 points. Today, the index has so far moved only slightly further up with 0.14%. In the long-term downtrend, the price last marked a high at around 3969 points. The reason for the increase was the surprisingly positive inflation data from the USA, which confirmed a slight decline in inflation. The last low before that was at around 3700 points on November 3. achieved.

Outlook

The chart situation in the daily chart has not changed much this week. In the area around 3860 points, a short-term relevant horizontal support has been established. The next important resistance is found in the area of 4120 points. If the price continues to stay above the support and respects it, this can be interpreted as a bullish signal. However, if this is breached, we could see a downward movement towards 3800 points. Otherwise, the price could rise to the aforementioned resistance. Above the resistance area at around 4100 points, the 200-day moving average and the long-term downtrend line since December 2021 can also be found, which could act as further resistances in the event of a continuing recovery movement.