Review

The price of the US crude oil futures is now already in the fourth week of losses. The main reason for the weak market situation at present is the rising key interest rate of the U.S. Federal Reserve. Tight monetary policy is also weighing on overall market liquidity. High interest rates also affect economic activity and weigh on demand for crude oil in the industrial sector. The combination of high inflation and rising interest rates is dampening private consumer demand for gasoline. Also, the U.S. government has increased crude oil supply by releasing the Strategic Petroleum Reserve, which has also had a price-reducing effect on the market.

Current

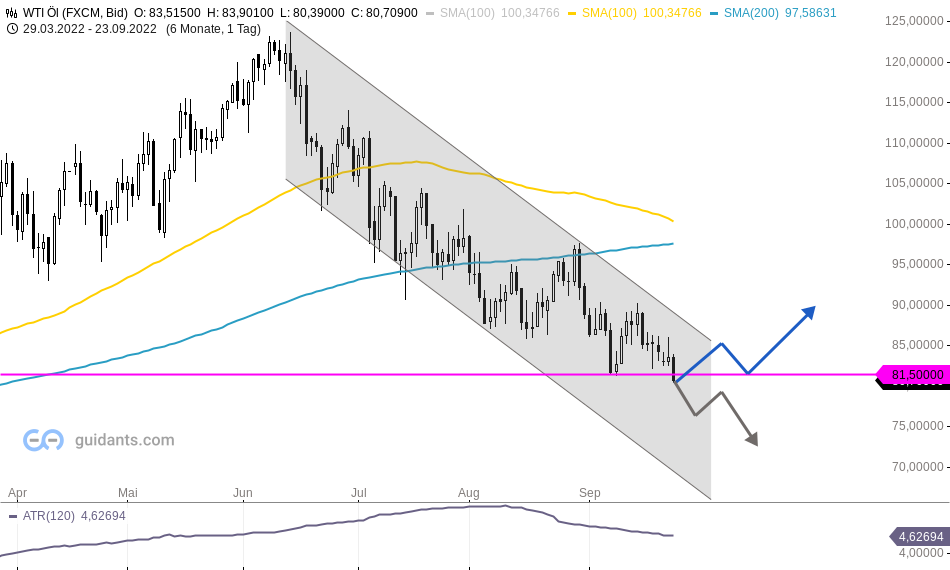

The oil price, which has been in a downward channel since June, fell again today by 2.4%. With the price currently at $81.58, it is hitting support at $81.50, which it successfully tested earlier this month. If the support holds this time as well, the oil price could turn back towards $90.00 and possibly even break out of the channel to the upside, which would be a bullish signal. However, a continuation of the current downward movement to the next supports at $75.00 and $72.50 is more likely.