Today we will take a closer look at the gold market.

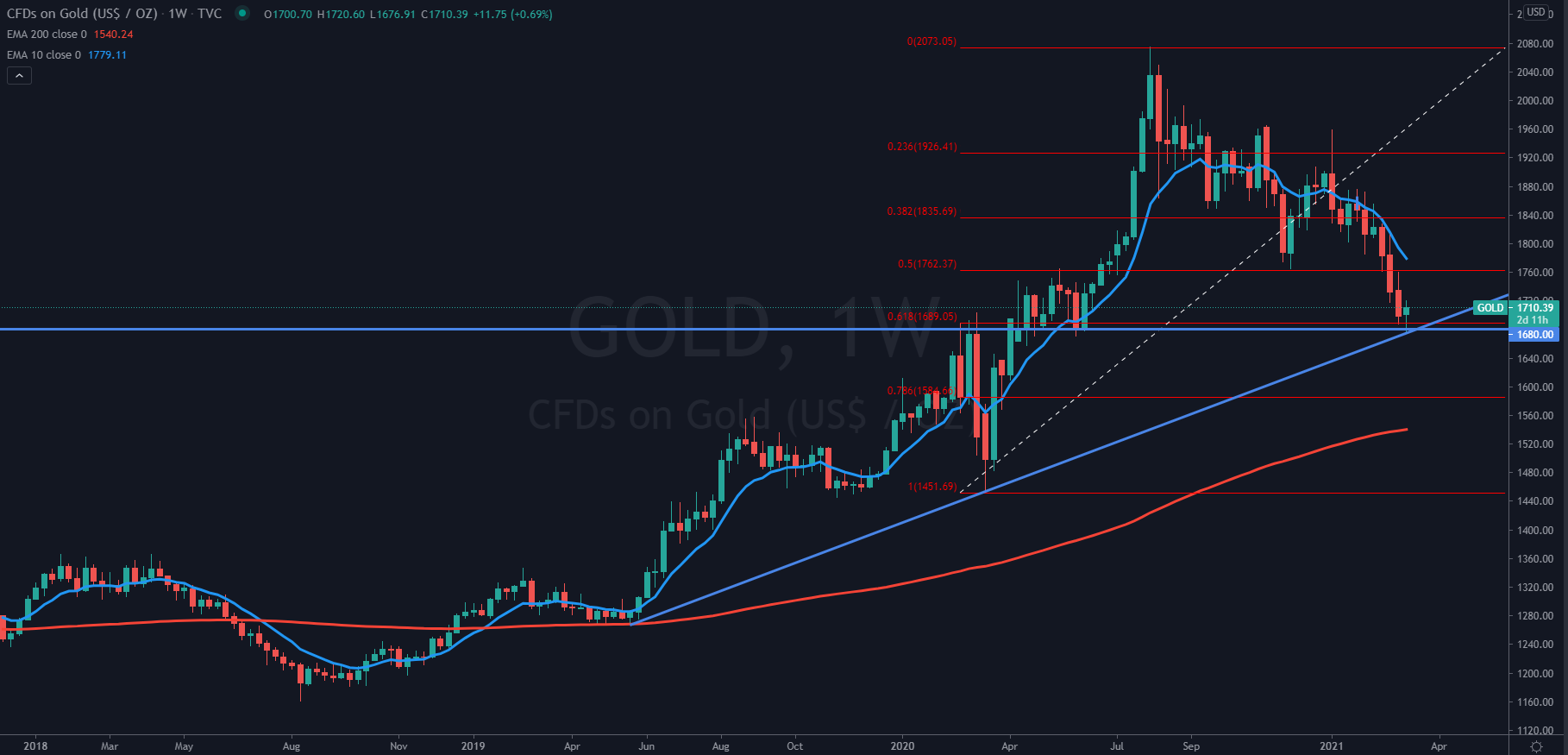

This is because gold has lost a lot of its value in recent weeks. Despite the fact that gold is considered a hedge against inflation, the price per ounce has been under strong pressure since the summer of 2020. After hitting a new all-time high on August 7, 2020 at USD 2075 per troy ounce of gold, the gold price is currently trading at USD 1710. But why is the precious metal falling?

The recent rise in interest rates and the strength of the dollar hit gold hard. US government bonds with a ten-year maturity have enabled a yield of more than 1.61% p.a. at their peak. Just a reminder: at the end of December, this figure was only 0.91%.

Nevertheless, there is considerable selling interest in the gold markets – especially in the futures markets as well as in the ETF sector. The world’s largest gold ETF, SPDR Gold, has seen capital outflows in recent weeks as large as they were last seen in 2013.

From a technical perspective, gold is currently in a very interesting spot for buyers. Gold has strong support in the 1680 area, an uptrend line and is at correction levels of the last uptrend. These are therefore good conditions for a trend reversal and rising prices.