The Triple A Project strong primarily aims to make investments in energy-efficient projects more attractive and to support project developers and financial institutions in their decision-making through a transparent and predictable selection process. Case studies that promote sustainable growth while complying with given regulations are analyzed and tracked throughout their lifecycle.

The assessment is based on Member States’ risk profiles and mitigation measures. A web-based database on the financing of implemented example energy efficiency projects allows for national and sectoral comparability, identification of market readiness, and sharing of best practice experience, thus reducing uncertainty for investors. The assessment tool developed in this step is used to assess risk. First, the compliance of the planned energy efficiency investments with the EU taxonomy is verified and ensured. This achieves a pre-selection of investment ideas at EU level depending on the context of the country and the specific characteristics of the sectors. It also considers the classification of financial instruments and risk mitigation strategies. This assessment is performed by the Triple A Assessment Tool.

In Step 2, key performance indicators (KPIs) were selected to determine the triple-A investments per case study country from the pipeline of the previous step. The benchmarking methodology is based on a multi-criteria classification taking into account the main economic, risk and energy criteria of the Sustainable Development Goals (SDGs). By applying this methodological step with the help of the Triple-A-Agreement tool, a benchmarking and optimization of the project ideas is performed.

The third step is to recommend which energy efficiency investments are realistic and feasible in the national and sectoral context and how they could be financed in practice in the short or medium term. The assign tool developed for the requirements of this methodological step consists of a multidimensional platform with numerous interfaces. Each interface is designed to meet the needs of each type of energy efficiency beneficiary as well as the needs of investors. The analyzed and benchmarked project ideas from the previous steps are brought to this final stage to take their final form: the Triple A project sheets, which can be presented to modern financing systems and potential investors, and on the basis of which implementation can be initiated(contracts, subscription procedures, etc.).

The three Triple-A standard tools are Web-based applications ( https://toolbox.aaa-h2020.eu/ ) that

Provide information on identifying, evaluating, and financing triple-A investments.

Database

The web-based Triple-A database is an interactive visualization of the Triple-A risk analysis of energy efficiency financing. Specifically, the database includes interactive maps and graphs that provide data on risks and uncertainty factors that could reduce investment profitability and jeopardize loan repayment for RE projects, as identified and categorized using the Triple A risk assessment methodology. The range of risks considered covers the general and practically relevant factors common to EE projects.

Visit the web-based Triple-A database here!

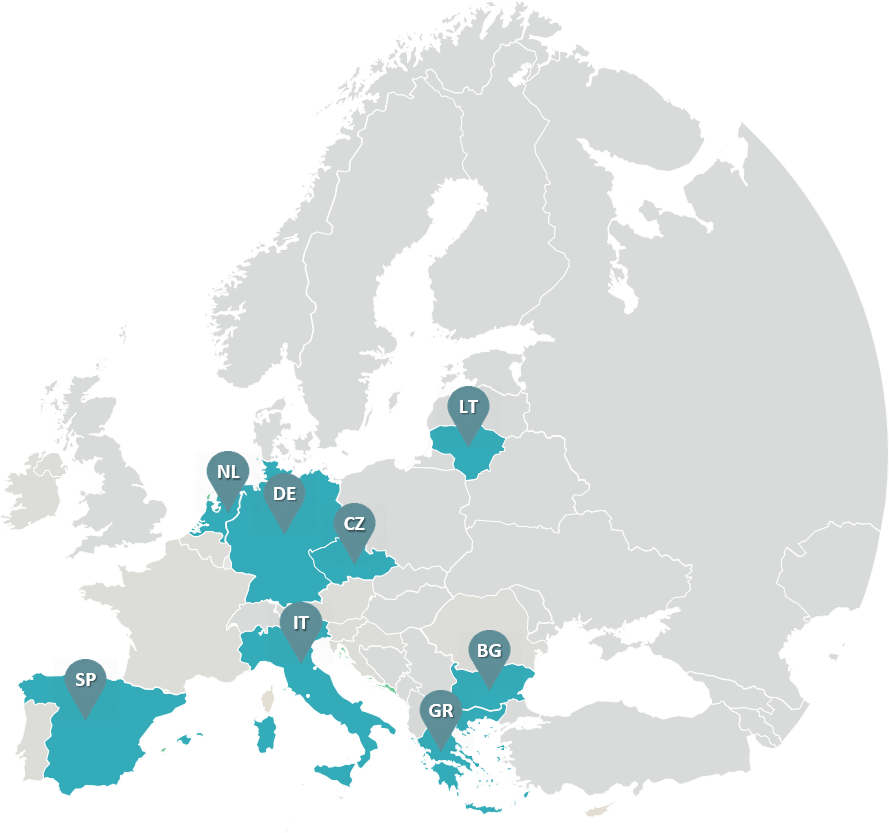

The Triple A project is being carried out by a consortium of academic, research and industrial partners from Bulgaria, the Czech Republic, Germany, Greece, Italy, Lithuania, Spain and the Netherlands.

The focus is on answering the following questions:

How can the financing instruments and risks be assessed at an early stage?

How can Triple A investments be implemented based on selected key indicators?

How can the identified investment ideas be assigned to possible financing models?

Triple–A Tool Guide

Consortium/Partner

The Triple A project was funded by the European Union from the Horizon 2020 research and innovation program of the European Union.

supported under grant agreement No. 784974.The content reflects the views only of the authors, and the European Commission is not responsible for any use that may be made of the information contained therein.