Review:

Everything Lagarde had told yesterday at the ECB press conference was known and no surprise. However, the announcement of the interest rate turnaround (nothing happened at all yesterday) was enough to send the index on a downward slide in the late afternoon. The sharp sell-off of the U.S. indices in the afternoon has played into the hands of the bears, too great was apparently the fear of the U.S. inflation data due in the afternoon.

Outlook:

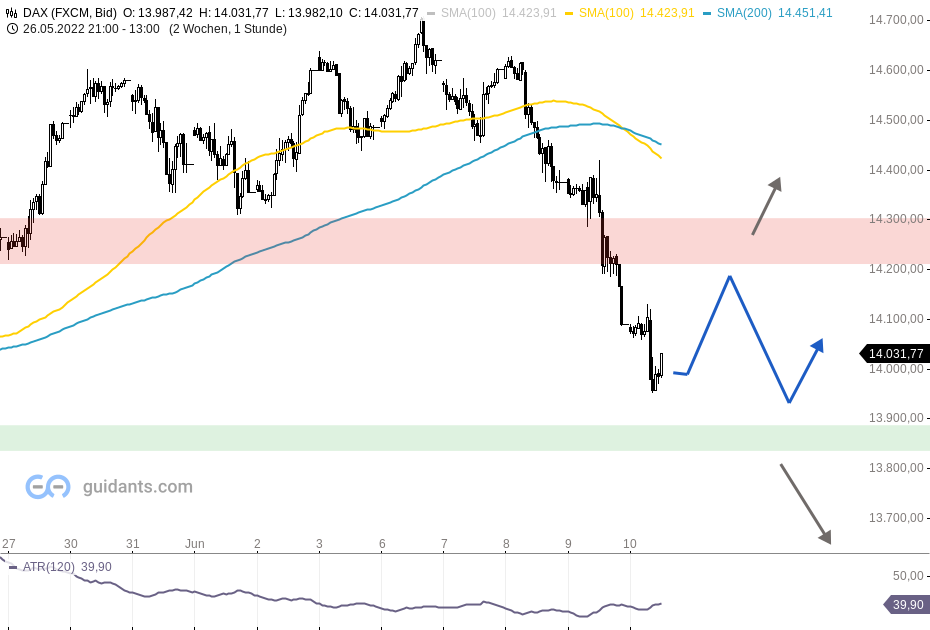

Against the backdrop that there was actually no news yesterday, the sell-off to 13,950 points this morning initially seemed grossly exaggerated. Fear of the U.S. inflation data due at 2:30 p.m. was probably the price driver. And that brings us to the most important event of today’s trading day: US consumer prices are expected in just over 50 minutes. If these are higher than expected, a further sell-off (down to 13,900 points?) is likely to occur in the environment of the US opening. If the data is in line with expectations, the indices would initially breathe a sigh of relief. This could catapult the German stock market barometer quickly back into the area around 14,200 points in the afternoon. We’ll know more at 2:30 p.m. Of course, the overarching picture remains bearish for the time being, but in the short term, the index is massively oversold.